What are the Alternatives to Bridging Loans?

While a bridging loan can be a useful tool for certain types of financing needs, it may not always be the best option for everyone.

Here are a few reasons why you might consider an alternative to a bridging loan:

- High interest rates: Bridging loans can have high-interest rates and fees compared to other types of loans, which can make them more expensive over time.

- Short-term nature: Bridging loans are typically designed for short-term financing needs, such as covering the gap between the purchase of a new property and the sale of an existing property. If you’re looking for longer-term financing, such as for a home renovation project, you may want to consider other options that offer more flexibility and lower interest rates.

- Risky nature: Bridging loans can be risky, as they are secured against the property being sold. If you are unable to sell the property or the sale falls through, you could be left with a significant amount of debt that you are unable to repay.

- Other options available: There are many other financing options available, such as home equity loans, personal loans, and credit cards, that may offer more favourable terms and be better suited to your individual needs and financial situation.

Ultimately, it’s important to carefully consider your financing options and choose the option that best meets your needs and budget. Be sure to compare interest rates, fees, and terms carefully when considering different types of loans, and work with a reputable lender to ensure that you’re getting a good deal.

What are the other options?

Remortgaging your property

Remortgaging your property is one way to get financing by borrowing against the equity in your home. Essentially, remortgaging means taking out a new mortgage on your property while paying off your existing mortgage.

Here are the steps you need to take to get financing by remortgaging your property:

- Assess your current mortgage: Before considering remortgage, you should review your current mortgage agreement to see if there are any early repayment charges or exit fees. This will give you an idea of whether it is worth remortgaging and whether you will save money by doing so.

- Determine the value of your property. You will need to have your property valued to determine its current market value. This will help you to understand how much equity you have in your property, which is the difference between the value of your property and the outstanding mortgage amount.

- Shop around for remortgage deals. Once you have assessed your current mortgage and determined the value of your property, you can start shopping around for remortgage deals. Consider factors such as the interest rate, term, fees, and any additional benefits such as cashback or free valuations.

- Apply for a remortgage: Once you have found a suitable remortgage deal, you will need to apply for it. The lender will review your application, credit history, and affordability and may require additional documentation such as proof of income and identification.

- Pay off your existing mortgage: If your application is successful, the new lender will pay off your existing mortgage, and you will start making payments on the new mortgage.

- Use the released equity: If you have sufficient equity in your property, you can use the released equity to finance a variety of needs, such as home improvements, debt consolidation, or investing in a business.

It’s important to note that remortgaging comes with its own risks, such as increasing your debt or monthly payments, and should be approached with caution. It’s important to seek independent financial advice before making any decisions.

Taking out a secured loan

Secured loans and bridging loans are two different types of financing options that are often used for different purposes. A secured loan is a loan that is backed by collateral, such as a house or a car, while a bridging loan is a short-term loan that is often used to bridge the gap between the sale of one property and the purchase of another.

If you are looking for a financing option that offers lower interest rates and longer repayment terms, then a secured loan may be a good alternative to a bridging loan. With a secured loan, you can borrow a larger amount of money and spread the repayment over a longer period of time. This can help you manage your cash flow more effectively and avoid the high-interest rates and fees associated with a bridging loan.

Another advantage of a secured loan is that the interest rates are typically lower than those of an unsecured loan or a bridging loan because the lender has the security of your collateral. This means that you may be able to save money over the long term by choosing a secured loan instead of a bridging loan.

However, it’s important to remember that a secured loan also carries the risk of losing your collateral if you are unable to make the payments on time. So, it’s important to make sure that you can afford the repayments before taking out a secured loan.

In summary, if you are looking for a financing option that offers lower interest rates and longer repayment terms and you have collateral to secure the loan, then a secured loan may be a good alternative to a bridging loan.

Personal unsecured loan

A personal unsecured loan is a type of loan that does not require collateral to secure the loan. Instead, the lender will assess your creditworthiness based on your credit score, income, and other financial factors. A bridging loan, on the other hand, is a short-term loan that is typically secured against a property or other assets.

There are several reasons why a personal unsecured loan may be a good alternative to a bridging loan:

- Lower interest rates: Personal unsecured loans typically have lower interest rates than bridging loans. This is because the lender is taking on less risk by not requiring collateral. As a result, you may be able to save money on interest charges by choosing a personal unsecured loan instead of a bridging loan.

- Longer repayment terms: Personal unsecured loans also typically offer longer repayment terms than bridging loans. This can make it easier for you to manage your cash flow and repay the loan over a longer period of time.

- No risk of losing collateral: With a personal unsecured loan, you do not have to put up any collateral to secure the loan; this means that you do not have to worry about losing your property or other assets if you are unable to repay the loan.

- More flexible: Personal unsecured loans are also typically more flexible than bridging loans. You can often use the funds for a wider range of purposes, and the loan application process is often faster and simpler.

Overall, if you do not have collateral to secure a loan or if you want to avoid the risk of losing your collateral, a personal unsecured loan may be a good alternative to a bridging loan. It’s important to compare interest rates and repayment terms from different lenders to find the best option for your needs.

Let-to-buy mortgages

A let-to-buy mortgage is a type of mortgage that allows you to convert your existing home into a rental property while you purchase a new home to live in.

This can be a good alternative to a bridging loan for several reasons:

- Avoid paying two mortgages: With a let-to-buy mortgage, you can avoid paying two mortgages at the same time. This is because you can use the rental income from your existing property to help cover the mortgage payments while you move into your new home. This can be a more cost-effective solution than taking out a bridging loan, which can be expensive and have high-interest rates.

- No need to sell your existing property: With a let-to-buy mortgage, you don’t have to sell your existing property in order to purchase a new one; this can be beneficial if you want to keep your existing property as an investment or if you are unable to sell it quickly enough to finance the purchase of your new home.

- Longer repayment terms: Let-to-buy mortgages typically have longer repayment terms than bridging loans, which can make the monthly repayments more affordable. This can be helpful if you are on a tight budget or if you are worried about your ability to make the repayments on a bridging loan.

- Lower interest rates: Let-to-buy mortgages also tend to have lower interest rates than bridging loans, which can save you money over the long term. This is because let-to-buy mortgages are usually longer-term mortgages while bridging loans are short-term loans.

Overall, a let-to-buy mortgage can be a good alternative to a bridging loan if you are looking to purchase a new home while keeping your existing property as an investment. It can help you avoid paying two mortgages at the same time and provide you with a more affordable and longer-term financing solution.

Asset refinancing

Asset refinancing is a financing option that involves using existing assets, such as equipment, machinery, or property, as collateral for a loan.

This can be a good alternative to a bridging loan for several reasons:

- Lower interest rates: Asset refinancing typically offers lower interest rates than bridging loans. This is because the lender has the security of your existing assets, which reduces the risk of default.

- Longer repayment terms: Asset refinancing also typically offers longer repayment terms than bridging loans. This can make it easier to manage your cash flow and repay the loan over a longer period of time.

- There is no need to sell assets. With asset refinancing, you do not have to sell your assets in order to secure the loan. This can be beneficial if you want to keep your assets for future use or if you are unable to sell them quickly enough to finance the purchase of a new property.

- More flexibility: Asset refinancing can also be more flexible than bridging loans. You can often use the funds for a wider range of purposes, and the loan application process is often faster and simpler.

Overall, asset refinancing can be a good alternative to a bridging loan if you have existing assets that you can use as collateral. It can provide you with lower interest rates, longer repayment terms, and more flexibility than a bridging loan. However, it’s important to remember that asset refinancing also carries the risk of losing your assets if you are unable to make the payments on time. So, it’s important to make sure that you can afford the repayments before taking out an asset-refinancing loan.

How to Finance the Purchase of a Listed Building

Ownership of a listed building in the UK comes with a long list of pros and cons.

On the plus side, you may find yourself in possession of a completely unique property with the potential to generate huge capital gains over the course of time. Not to mention, it is an inspiring place to call home for yourself and your family.

In terms of disadvantages, the upkeep of a listed building can be much more of a challenge than that of a conventional home. There may also be strict limitations placed on modifications that can be made to the property (inside and out), ruling a great many potential renovations and improvements out of the equation.

Then comes the small matter of funding the purchase of a listed building, which is not quite as easy as simply shopping for a conventional mortgage.

There are three types of listed properties in England and Wales, which in all instances call for an entirely different type of mortgage:

- Grade 1: Buildings of outstanding or national architectural or historic interest

- Grade 2: Particularly significant buildings of more than local interest

- Grade 2: Buildings of special historic or architectural interest

The overwhelming majority of listed buildings (around 92%) fall within the Grade 2 category. This means the lowest level of protection and preservation, but at the same time, it can still result in major restrictions on what can actually be done with the property you buy.

For example, you may need to obtain formal planning permission simply to upgrade the windows or doors or to install exterior decking.

But many would argue that what you get in return more than justifies the downsides. Living in a listed property can be a genuine joy, but how do you fund the purchase of a listed building in the first place?

The Grade 2 listed property mortgage market

Qualifying for (or even tracking down) a mortgage for a Grade 2 listed property on the High Street can be difficult. Many lenders do not offer such products at all, and those that do have a tendency to restrict them to borrowers who fulfil fairly extensive eligibility requirements.

For example, interest rates on a mortgage for a listed property will usually be similar to those of a conventional mortgage. But while a standard mortgage may call for a minimum deposit of just 10%, it is often necessary to provide a deposit of 25% to 30% for a specialist mortgage for a listed building. In addition, it is not always possible to take out a mortgage on a listed building over a term of more than 20 years.

Mortgage availability and qualification criteria differ significantly from one type of listed building to the next. In the case of a listed property that features outbuildings, comes with a significant amount of land attached, or is used for any type of commercial or semicommercial purposes, finding an accessible and affordable mortgage can be more difficult.

Purchasing listed properties with specialist loans

Enlisting the support of an experienced broker can simplify the process of tracking down an affordable mortgage for a listed property. There are countless options available on the secured lending market, including short-term bridging loans.

Unlike a traditional mortgage, a bridging loan can be arranged within a few working days, and the funds can be used to purchase any type of property in any state of repair. They can also be taken out by individuals with poor credit, no formal proof of income, or even a history of bankruptcy. Whether you are planning to live in the property yourself, retain ownership for BTL purposes, or sell it on for capital gains upon completing any necessary refurbishments, a bridging loan can be a uniquely flexible and cost-effective solution.

How to Sidestep the Risk of a Broken Property Chain

Research from Home Selling Expert suggests that a full 31% of all UK home sales fall through at least once before a transaction is completed. This essentially means that buyers and sellers alike have a one in three chance of their plans being laid to waste by broken property chains.

A broken property chain occurs when one or more links in the chain of buyers and sellers fall through, resulting in the entire process being delayed or falling apart. This can be frustrating and costly for all parties involved, but it is also something that can be avoided in many instances.

Of course, there is very little anyone can do to control the behaviour of others involved in a property chain. Buyers and sellers alike are at the mercy of others within the chain, over whom they have little to no influence.

Even so, there are several steps that buyers and sellers can take to reduce the risk of a broken property chain.

Examples of these include the following:

- Be honest and open. It is important for buyers and sellers to be upfront about their circumstances and any potential issues that could affect their ability to complete the sale. This includes disclosing any financial issues, such as credit problems or debts, as well as any concerns about the condition of the property.

- Get a mortgage in principle: Buyers should obtain a mortgage in principle before starting the property search. This will give them a better idea of what they can afford and can also help speed up the process once a property has been found.

- Choose a reputable conveyancer: Both buyers and sellers should work with a reputable conveyancer to handle the legal aspects of the sale. A good conveyancer will be able to identify any potential issues and work to resolve them in a timely manner.

- Be prepared for delays. Even with careful planning, delays can still occur. It is important for buyers and sellers to be prepared for this possibility and to have contingency plans in place in case the sale is delayed.

- Be patient: The property process can be stressful and time-consuming, and it is important for all parties to remain patient and flexible.

- Get a survey: Both buyers and sellers should consider getting a survey of the property before the sale. This can help identify any potential issues and allow both parties to address them before the sale is completed.

- Consider a bridging loan: If there is a significant gap between the completion dates of the two properties, buyers may want to consider a bridging loan to cover the period in between. This can help reduce the risk of the sale falling through due to financial issues.

- Get a HomeBuyer report: A HomeBuyer Report is a detailed document that covers the condition of the property and any issues that need to be addressed. This can help buyers understand the true condition of the property and make informed decisions about the purchase.

Of the mitigation methods outlined above, the single best way to reduce the risk of a broken property chain is to accelerate the completion process with bridging finance.

Bridging loans afford mainstream bidders all the benefits usually reserved for cash buyers. Secured against the value of their current home, bridging finance can be arranged and accessed within a few working days, enabling buyers to beat competing bidders to the punch. For more information on any of the above or to discuss the benefits of bridging finance in more detail, contact a member of our team anytime for an obligation-free consultation.

Bridging Loans to Address ICR Issues

The recent raft of Bank of England interest rate hikes and subsequent mortgage rate increases came as no real surprise. Quite the opposite, as it had been common knowledge for some time that the historic lows the UK had become used to were on borrowed time.

Today, we are looking at a picture where millions of mortgage payers have found themselves struggling to make ends meet. Having signed up for ultra-low-interest fixed-rate deals some time ago, they have now been switched to standard variable-rate products with much higher rates of interest.

Elsewhere, you have those who are struggling to qualify for new mortgage loans in the first place, something that is not just affecting everyday home buyers but is also having a major impact on the property purchase decisions of BTL investors.

Meeting ICR requirements

Increasingly, BTL investors are finding it difficult to meet the interest cover ratio (ICR) set by major lenders as a key aspect of their eligibility requirements. This is where the interest payments on a buy-to-let mortgage are compared with projected rental income.

Typically, BTL lenders have a minimum ICR requirement of around 145%. Unfortunately, this means that the recent interest rate hikes (and the prospect of further hikes to come) mean that BTL investors must now produce evidence of higher projected rental income on the properties they plan to purchase.

Something that inherently means hiking monthly rents and potentially making their properties less attractive to prospective tenants could also be completely out of the question in some scenarios, such as a property with a reliable long-term tenant already in place that you would like to hang onto.

Bridging the gap

Over the past couple of years, investors looking to pick up BTL homes with high potential have been demonstrating greater interest than ever before in bridging finance. Bridging loans work in an entirely different way from conventional mortgages, in that they are strictly short-term solutions.

A bridging loan is a secured loan issued over a term of up to 12 months and, in many instances, can be arranged within a few working days. The loan is secured against assets of value (usually residential or commercial property), and the funds raised can be used for any legal purpose.

All of this has made bridging finance particularly attractive to investors in search of more flexible and accessible options than conventional BTL mortgages. With a bridging loan, there are no minimum ICR requirements whatsoever, and you do not need to provide any evidence of a background in property investments.

If you have sufficient assets of value to cover the costs of the loan and a workable exit strategy (how the loan will be repaid), this is often all that matters to bridging loan specialists.

This can help BTL property investors bridge the gaps in the services being provided by mainstream lenders. With a bridging loan, a buyer can purchase a high-potential BTL property in any condition and conduct the renovations and improvements necessary to bring it up to scratch. Interest then accrues at a rate as low as 0.5% per month, giving the investor plenty of time to work out their next step.

When the agreed loan term ends, the bridging loan can be refinanced onto a longer-term facility, such as a BTL mortgage. Or if rates are still far from agreeable, the property can be sold to generate significant capital gains and repay the loan in full.

Essentially, bridging finance is about giving investors welcome breathing space, during which they can think carefully about their longer-term decisions.

Six Ways a Bridging Loan Can be Better Than a Mortgage

Most homeowners looking to relocate barely think twice about completing a mortgage application. They simply apply for and (perhaps) receive a mortgage instinctively, locking themselves into the same binding long-term agreements as everyone else.

But what if there was a better way for existing homeowners to move to new homes without going down the usually complex and costly channels? Are there flexible, accessible, and affordable alternatives to conventional mortgage loans that are broadly available to mainstream borrowers?

Surprisingly, the answer is yes, and it takes the form of bridging finance.

To put the whole thing into some kind of perspective, here are just six of the countless ways a bridging loan can be better than a mortgage:

- Faster applications: With a mortgage application, it is not uncommon to wait up to 8 or even 12 weeks to gain access to the money you need. With bridging finance, the whole process can be wrapped up in just a few working days, never more than a couple of weeks. When time is a factor (which has a tendency to apply to all property purchases these days), bridging finance can be so much faster to arrange than a conventional mortgage.

- Property purchases for cash: With bridging finance, you essentially turn yourself into a cash buyer. By doing so, you gain access to all the benefits usually reserved for those who buy homes for cash. You can bid on properties at auction, you can place offers on off-market properties of all kinds, and you can qualify for preferential rates by buying your next home for a single (and fast) lump-sum cash payment.

- Easy to obtain: Comparatively speaking, obtaining a bridging loan can be surprisingly straightforward. Eligibility criteria for bridging loans tend to be much more relaxed than with a conventional mortgage. Your credit history and income level will not necessarily stand in your way, just as long as you provide your lender with proof of a viable exit strategy (how you intend to repay your loan). It is even possible to qualify for bridging finance with no formal proof of income and/or a history of bankruptcy.

- Can be used to purchase any property: Major banks place heavy restrictions on the kinds of properties their mortgages can be used to purchase. Elsewhere, bridging loan specialists place no such restrictions whatsoever on their products. If you qualify for a bridging loan, you can use the funds to purchase any type of property you like. This includes properties that would normally be considered ‘not mortgageable’, making it much easier to pick up homes in questionable conditions to then renovate to a higher standard.

- Rock-bottom interest rates: Bridging finance is designed to be repaid as promptly as possible and can be hugely affordable as a short-term solution. Interest is applied monthly at a rate as low as 0.5%, and all other borrowing costs are kept to the bare minimum. Most bridging finance specialists impose no fees or penalties for early repayment, meaning significant sums of money can be saved by repaying the full balance as quickly as possible. Unlike a mortgage, where early repayment can be extremely expensive, assuming it is even an option at all,

- No restrictions on spending: A traditional mortgage comes with the caveat of being issued exclusively for the purchase of a property. With bridging finance, the money can be used for absolutely any legal purpose whatsoever. You could use a chunk of the money to purchase a home or business property and spend the rest in any way you like. Lenders have little to no interest in how their money is to be used; they simply need to know that they will get it back in full and on time.

Q3 Bridging Loan Transactions Hit New Record High, Despite Higher Interest Rates

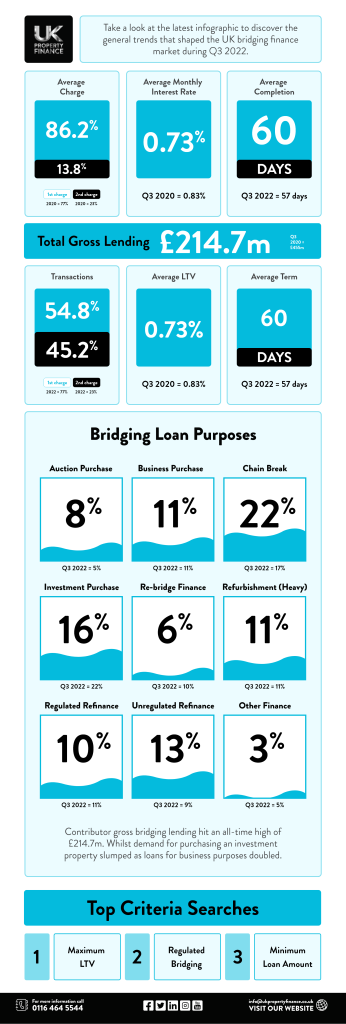

For the first time this year, average bridging loan interest rates increased slightly in Q3. But rather than adversely affecting the sector’s popularity and performance, data from Bridging Trends indicates quite the opposite. In the face of adversity, the UK’s bridging finance sector enjoyed its strongest quarter on record in terms of gross contributor lending.

Compared to Q2, quarterly performance increased by a huge 30% in Q3; a total of £214.7 million in bridging loans was transacted across the UK, up from £178.4 million in Q2. This is the highest combined contributor lending total recorded since 2015, when Bridging Trends was launched.

Of equal significance, the Bridging Trends report also showed a major shift in how bridging loans are being used by UK borrowers. For the first time, preventing a property chain break became the top use for bridging finance, accounting for a full 22% of all transactions (up from 21% in the previous quarter).

This bucked the trend of the five prior consecutive quarters when purchasing investment properties was the most common use for bridging finance.

“Following the base rate rises we’ve seen throughout this year and mortgage interest rates increasing across the industry, it’s no surprise that chain break bridging is the biggest use of funds for the quarter,” said Stephen Watts, Bridging & Development Finance Specialist at Brightstar.

“Borrowers that have had mortgage products withdrawn from them with little or no notice or have lost their sale due to their buyers no longer fitting mortgage affordability criteria would then turn to short-term funding solutions to ensure their purchase can still go through as planned. It will be interesting to see how this impacts next quarter’s data.”

Attributed largely to the growing uncertainty that continues to plague the UK economy, the use of bridging finance for investment property purchases plummeted from 24% in Q2 to 16% in Q3.

Interest rates are up slightly

Meanwhile, the average monthly interest rate payable on a bridging loan increased slightly for the first time, up from 0.69% in Q2 to 0.73% in Q3. However, this seemingly had no impact whatsoever on overall bridging activity, which reached a new record high between July and September.

There was also a slight increase in the average loan-to-value level of bridging products issued in Q3—up from 56.2% in Q2 to 59.6%. Regulated bridging loans accounted for 45.2% of all transactions, up slightly from 43.3% in the previous quarter. Average completion times increased slightly to 60 days in Q3 (an increase of three days compared to Q2), which may be a reflection of the record demand for bridging finance also recorded during this period.

While average interest rates continue to hover close to previous record lows, experts believe that further increases over the coming months may be all but inevitable.

“Considering the volumes we have seen in Q3, bridging finance clearly continues to be a useful tool for homeowners and investors alike. What has been interesting is the drop-off in bridging being utilised for investment purchases, which is likely due to buyers taking stock of the current market. While it’s too early for us to really feel the impact of September’s mini-budget, I expect this will be more visible in Q4,” said Gareth Lewis, Commercial Director at MT Finance.

“As predicted in Q2, interest rates have started to slowly rise to 0.73%, but it is worth noting they are virtually on par with Q3 in 2021 (0.72%). What comes next remains to be seen, but I would not be surprised if interest rates continue to rise and investors remain cautious.”

Challenges and Opportunities Ahead for the Bridging Sector

As things stand, you would be hard-pressed to find anyone with genuine optimism for the immediate economic outlook. Inflation in the UK is already hovering close to 11%, but experts are increasingly predicting a peak of almost 19% in the early stages of next year. All of this is likely to make the current living-cost crisis seem insignificant when compared with the economic hardship to come.

Consumer confidence is as low as it gets, average wages are in no way keeping up with escalating living costs, and people are being forced to make all sorts of modifications to their spending patterns simply to make ends meet.

Sadly, experts like Nick Jones, sales director for bridging finance at lender West One Loans, only see things getting worse before they get better.

Flexible finance in troubled times

But while the overall picture is somewhat pessimistic, it may not all be doom and gloom. With the growing availability and affordability of bridging finance, more people and businesses than ever before will at least be able to tide themselves over if facing a temporary economic shortfall.

There will even be those who are able to capitalise on the economic downturn in order to make the best of a bad situation.

“There will be opportunities for customers who are looking to expand their portfolios and make investments, and we will be here to support them,” said Jones.

Elsewhere, bridging and development finance specialist at Brightstar, Stephen Watts, indicated that “bridging finance is being increasingly sought to enable buyers to put themselves ahead of their competition”.

With available housing inventory continuing to outstrip supply by a considerable margin, those able to do so are setting their sights on potentially profitable property investments. And in many cases, they use short-term bridging loans to expand their portfolios at relatively short notice.

Figures from the most recent Bridging Trends Report found that, in spite of the current economic chaos, bridging loan volumes for Q2 this year were up 14%. Throughout the first six months of 2022, the most popular application for bridging finance was picking up an investment property.

The speed and simplicity of home buyers and investors looking to take advantage of time-critical property purchase opportunities. Not to mention, jump the queue and escape the trappings of conventional property chains entirely.

Cash buyer benefits

But it is not just the UK’s more established property investors that are finding bridging finance a useful facility. Conventional homebuyers are finding it increasingly difficult to secure property purchases via conventional channels.

Today, the typical mortgage application takes approximately 12 weeks to underwrite, authorise, and issue. In the meantime, competing buyers have up to three months to submit a superior offer and beat you to the punch.

Coupled with the risk of the seller simply pulling out of the deal at any time, conventional home purchases are becoming increasingly difficult.

With bridging finance, homebuyers can gain access to the benefits of purchasing properties as cash buyers. They borrow against their current home, they fund the purchase of their next home in a matter of days, and they beat all competing bidders to the punch.

In doing so, they eliminate the risk of being gazumped at the last minute and benefit from the property price discounts afforded exclusively to cash buyers (often up to 2% of the total property price).

For as long as the economic situation in the UK remains unstable, the appeal of bridging finance will continue to grow. Particularly for those who are asset-rich but cash-poor, bridging finance can be the ultimate affordable stopgap solution for times of economic turbulence.

How to Get the Most Out of Your First (or Next) Bridging Loan

A bridging loan can be just the thing to get you out of a pinch when time is a factor. It can also be great for temporarily covering the costs of major purchases, investments, property upgrades, and so on.

Sourced from a reputable lender and repaid promptly, bridging finance has the potential to be highly cost-effective. Even so, it is essential to adopt the right approach when applying for bridging finance in the first place in order to ensure you get the best possible deal.

Like all financial products, bridging loans are not suitable for all borrowers and all applications.

With this in mind, here is a brief overview of eight essential tips to help you get the most out of your first (or next) bridging loan:

- Consider whether you really need a bridging loan: Taking on any debt when you do not genuinely need to is inadvisable. Bridging finance has the potential to be comparatively cheap but still constitutes a form of debt. Irrespective of your intentions for the loan, it is worth considering whether other means could be used to cover the costs. Your own savings, for example, could be used as an alternative, with no interest or borrowing costs imposed.

- Remember that bridging finance is a strictly short-term solution: Bridging finance is most affordable when repaid as quickly as possible. Bridging finance should not be taken out with the intention of long-term repayment, under any circumstances. Monthly interest can be as low as 0.5%, but prompt repayment is essential. Unless you are 100% confident in your short-term exit strategy, reconsider your bridging loan application.

- Learn how to get a safe and competitive bridging loan: Sourcing a bridging loan is only advisable when it comes from an established, reputable, and fully FCA-regulated provider. Comparing the market before finalising your decision is important, as is checking the feedback and reputation of your preferred issuer. Organise an obligation-free consultation with your provider ahead of time and see if they are the right fit for you.

- Look beyond interest rates alone: A monthly interest rate as low as 0.5% (sometimes even 0.4%) can seem irresistible. However, additional fees and borrowing costs almost always apply when taking out a bridging loan. Arrangement fees, administration fees, exit fees, and so on can vary from zero to around 2% of the loan value. It is therefore essential to consider the bigger picture rather than basing your decision on advertised interest rates alone.

- Proactively minimise borrowing costs: Contrary to popular belief, interest rates and borrowing costs are not entirely out of the hands of bridging loan customers. There is much that can be done to keep borrowing costs to the bare minimum, potentially adding up to significant savings. Examples include borrowing at a lower LTV, providing assets of value that exceed the total costs of the loan by a clear margin, repaying the loan as quickly as possible, not borrowing more than you need, and presenting rock-solid evidence of a viable exit strategy.

- Consider your credit score and financial status: Issues like a poor credit score, a history of bankruptcy, or no proof of income will not count you out of the running for a bridging loan. But when it comes to the most competitive deals on the market, lenders typically show preference for those with a credible financial profile. If you have poor credit (or any other issue on your financial track record), it is imperative that you target the right lenders with your applications.

- Apply early, where possible: Bridging finance is often turned to as a last-minute funding solution in time-critical scenarios. As is the case with all financial products, applying early, where possible, is better. The earlier you apply, the more time you will have to explore the options available and secure a competitive deal.

- Consider the alternatives to bridging finance: It is always worth considering the alternative options available, which may be better suited to your needs. Examples of this include secured business loans, second-charge mortgage products, credit cards, overdrafts, personal savings, specialist development finance, and so on. All of which will be discussed with your provider during your initial consultation, enabling you to find the perfect product to suit your requirements.

0116 402 7982

0116 402 7982