Q3 Bridging Loan Transactions Hit New Record High, Despite Higher Interest Rates

For the first time this year, average bridging loan interest rates increased slightly in Q3. But rather than adversely affecting the sector’s popularity and performance, data from Bridging Trends indicates quite the opposite. In the face of adversity, the UK’s bridging finance sector enjoyed its strongest quarter on record in terms of gross contributor lending.

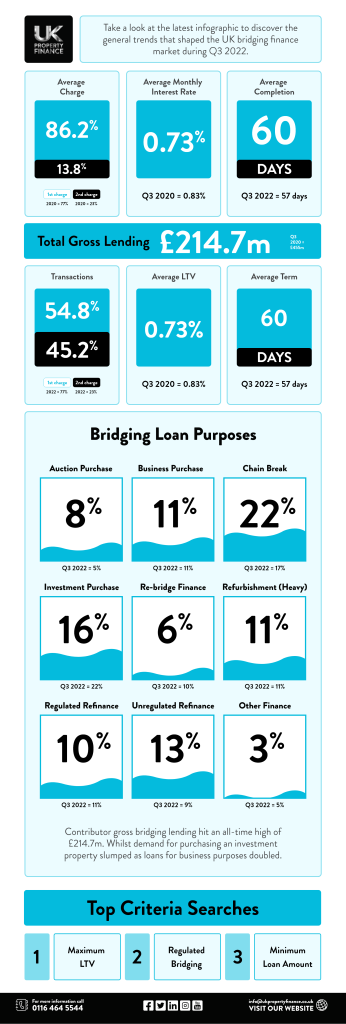

Compared to Q2, quarterly performance increased by a huge 30% in Q3; a total of £214.7 million in bridging loans was transacted across the UK, up from £178.4 million in Q2. This is the highest combined contributor lending total recorded since 2015, when Bridging Trends was launched.

Of equal significance, the Bridging Trends report also showed a major shift in how bridging loans are being used by UK borrowers. For the first time, preventing a property chain break became the top use for bridging finance, accounting for a full 22% of all transactions (up from 21% in the previous quarter).

This bucked the trend of the five prior consecutive quarters when purchasing investment properties was the most common use for bridging finance.

“Following the base rate rises we’ve seen throughout this year and mortgage interest rates increasing across the industry, it’s no surprise that chain break bridging is the biggest use of funds for the quarter,” said Stephen Watts, Bridging & Development Finance Specialist at Brightstar.

“Borrowers that have had mortgage products withdrawn from them with little or no notice or have lost their sale due to their buyers no longer fitting mortgage affordability criteria would then turn to short-term funding solutions to ensure their purchase can still go through as planned. It will be interesting to see how this impacts next quarter’s data.”

Attributed largely to the growing uncertainty that continues to plague the UK economy, the use of bridging finance for investment property purchases plummeted from 24% in Q2 to 16% in Q3.

Interest rates are up slightly

Meanwhile, the average monthly interest rate payable on a bridging loan increased slightly for the first time, up from 0.69% in Q2 to 0.73% in Q3. However, this seemingly had no impact whatsoever on overall bridging activity, which reached a new record high between July and September.

There was also a slight increase in the average loan-to-value level of bridging products issued in Q3—up from 56.2% in Q2 to 59.6%. Regulated bridging loans accounted for 45.2% of all transactions, up slightly from 43.3% in the previous quarter. Average completion times increased slightly to 60 days in Q3 (an increase of three days compared to Q2), which may be a reflection of the record demand for bridging finance also recorded during this period.

While average interest rates continue to hover close to previous record lows, experts believe that further increases over the coming months may be all but inevitable.

“Considering the volumes we have seen in Q3, bridging finance clearly continues to be a useful tool for homeowners and investors alike. What has been interesting is the drop-off in bridging being utilised for investment purchases, which is likely due to buyers taking stock of the current market. While it’s too early for us to really feel the impact of September’s mini-budget, I expect this will be more visible in Q4,” said Gareth Lewis, Commercial Director at MT Finance.

“As predicted in Q2, interest rates have started to slowly rise to 0.73%, but it is worth noting they are virtually on par with Q3 in 2021 (0.72%). What comes next remains to be seen, but I would not be surprised if interest rates continue to rise and investors remain cautious.”

0116 402 7982

0116 402 7982