Bridging Loan Calculator

A bridging loan calculator is a valuable tool that helps property buyers, investors, and developers estimate the costs of short-term financing. Whether you’re purchasing a new home before selling your current one, funding a property renovation, or securing a business investment, understanding how bridging loans work and their associated costs is crucial.

What is a bridging loan?

A bridging loan is a short-term finance option designed to “bridge the gap” between the need for immediate funds and a longer-term financial solution. These loans are typically secured against property or other valuable assets and are commonly used in property transactions.

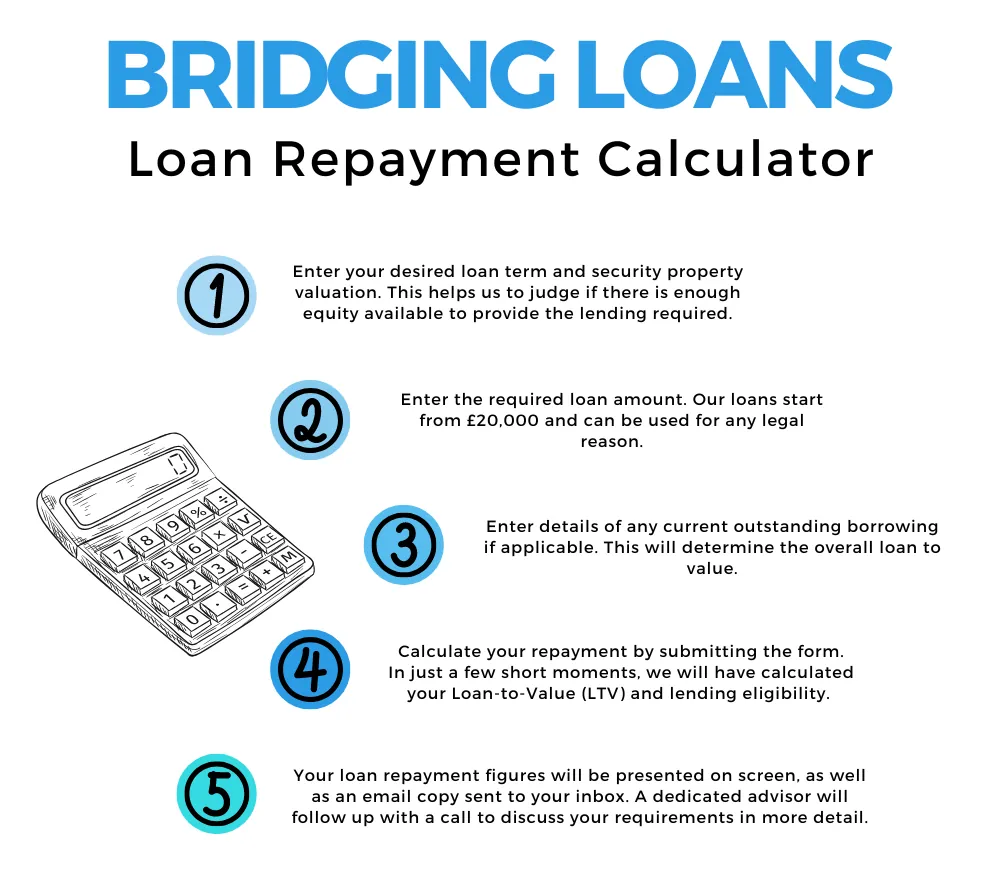

How does a bridging loan calculator work?

A bridging loan calculator provides an estimate of the total cost of borrowing by considering several key factors:

- Loan Amount: The sum you wish to borrow.

- Loan Term: The duration of the loan, typically ranging from a few months to a year.

- Interest Rate: Bridging loans often have higher interest rates than traditional mortgages, and rates can be monthly or annual.

- Loan Type: Whether the loan is open (flexible repayment) or closed (fixed repayment date).

- Exit Strategy: How you plan to repay the loan, such as selling a property or refinancing.

Key features

- Interest Calculation: Determines how much interest accrues over the loan term.

- Monthly Repayments: Shows whether interest payments are monthly or rolled up (added to the final repayment).

- Total Loan Cost: Calculates the full amount to be repaid, including fees.

- LTV Ratio: Assesses the loan-to-value ratio based on the security provided.

- Arrangement and Admin Fees: Factors in any lender fees that apply.

Why use a bridging loan calculator?

- Quick Cost Estimation: Get an instant estimate of your potential borrowing costs.

- Compare Loan Offers: Assess different lenders and loan structures.

- Financial Planning: Ensure you can afford repayments and avoid unexpected costs.

- Transparent Insights: Understand the breakdown of interest, fees, and repayment amounts.

Factors that affect bridging loan costs

Bridging loan costs can vary depending on several factors, including:

- Credit History: A strong credit profile can lead to better rates.

- Property Value: Higher-value properties may secure better loan terms.

- Loan-to-Value Ratio (LTV): Lower LTV ratios often attract lower interest rates.

- Exit Strategy: A clear and viable exit strategy can improve loan approval chances.

- Market Conditions: Economic factors influence lender rates and availability.

How to use a bridging loan calculator effectively

- Input Accurate Figures: Ensure you enter precise loan amounts, interest rates, and terms.

- Compare Different Scenarios: Adjust values to see how changes affect total borrowing costs.

- Factor in Additional Fees: Consider arrangement fees, legal costs, and valuation fees.

- Check Repayment Affordability: Ensure the estimated costs align with your financial plan.

A bridging loan calculator is a crucial tool for anyone considering short-term finance. It provides clear insights into borrowing costs, helping you make informed financial decisions. However, while a calculator offers valuable estimates, speaking with a financial adviser or lender ensures you get the best deal tailored to your needs.

Use a reliable bridging loan calculator today to gain a better understanding of your potential borrowing costs and secure the right finance for your situation.