Best Bridging Loan Calculator | UK Bridging Loan Rates 0.55%

Our bridging loan calculator gives a good indication of the expected rates and repayment costs.

When using our calculator, we will not perform credit checks, nor will we pass your information to any third party. We are committed to protecting your personal data and are registered with the Information Commissioner Office (ZA115985).

We won’t ask about your credit score or share your information with anyone else when you use our calculator. We promise to keep your personal information safe. Our registration number with the Information Commissioner’s Office is ZA115985.

Why use a bridging loan calculator?

Our bridge loan calculator helps you understand all the costs associated with getting a bridging loan.

Borrowers can use our bridging loan calculator. It gives you an accurate estimate of all expenses related to bridging finance before you apply. If you need help using the calculator, just call us and our team will be happy to assist you.

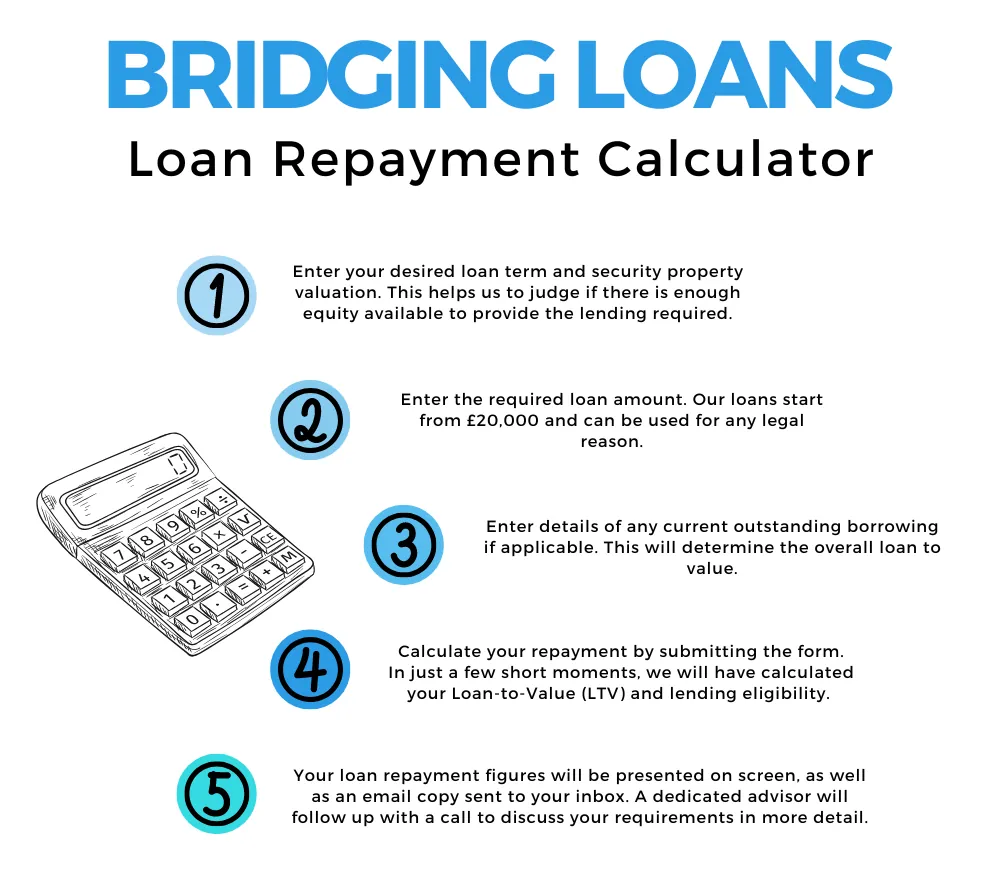

How to use our calculator

What information do we require?

Just fill in your personal information in the right sections and let the bridging calculator handle the rest for you.

You’ll need the following information:

- Type: options include standard, refurbishment, or a second charge loan.

- Term: What is the preferred duration of the loan term? Usually, up to 12 months is standard.

- Properties: The number of properties you have to offer for security.

- Valuation: of the property or properties offered for security.

- Loan Amount: Input the amount of funding you think you will need.

Once you have input your details, we will calculate all the costs attached to apply for and take out bridging finance. By utilising our calculator, you can have confidence that your credit rating will remain undisclosed. We will not share any of the information you provide with external organisations. Use our calculator to see the costs of getting bridging finance before you commit.

Our bespoke calculator will highlight all fees and charges typically included in the overall cost.

Once you’ve used the calculator to confirm the loan amount, we’ll reach out using the contact details you provided. Alternatively, feel free to call one of our financial advisors for further advice on your application.

How much does a typical bridging loan cost?

Lenders design bridging loans as short-term solutions with higher risk than standard mortgages. Lenders typically set higher interest rates based on your current financial situation.

How are bridging loan costs calculated?

There should be various factors that you will need to take into account:

- LTV (loan to value): is the ratio of the amount borrowed to the property’s value. The borrower uses the property as collateral. In general, the higher the LTV, the higher the interest rate offered, and vice versa. Put simply, if LTV is low, borrowers can expect favourable interest rates from most lenders.

- Regulated vs. unregulated: If the property will be the buyer’s main home, the loan will follow FCA rules. This means someone will regulate the loan. If the property is not the buyer’s main home, the loan will not be regulated. Investors will consider property purchases for investment purposes only as unregulated.

- The size of the deposit: This plays a significant role in shaping how lenders perceive your financial reliability. When you put a lot of money into your account, lenders see you as a safer borrower. This makes it more likely for you to get a bridging loan with a lower interest rate.

Lender fees are charges imposed by the bridging loan provider for setting up the loan. These fees usually amount to around 2% of the loan, but may vary slightly depending on the lender. - Legal fees: Completing legal paperwork is necessary for a bridging loan, just like it is for a regular mortgage. You need to find a solicitor who can handle all the legal aspects of bridging finance. In addition, you will be responsible for covering the expenses related to hiring a solicitor. Borrowers could also be liable for their own expenses in addition to those of the lender.

- Broker fees: Most brokers will charge a fee for their services. We highly recommend employing a bridging broker. They can find the best deals and help lower the total loan costs.

Valuation costs are necessary for bridge finance, which is a secured loan. This loan requires us to value the collateral to ensure the asset is worth enough.

Most lenders do not charge exit fees. However, for those that do charge an exit fee, it usually falls between 1% and 2%. You must pay this fee when repaying the bridging loan.

How is interest calculated?

The calculation of bridging finance interest differs greatly from that of typical mortgage interest. Lenders calculate bridging finance differently than traditional mortgage products because of the way they calculate interest. Lenders calculate the interest on long-term debt, such as a mortgage, annually. The lender fixes the interest on a bridging loan on a monthly basis.

Borrowers typically return bridging loans within 12 to 18 months. The borrower pays less interest if they return the loan ahead of schedule.

Many lenders offer rolling-up interest. This means that the interest accumulates over time. The borrower then pays it in one lump sum at the end of the loan term.

Bridging Loan Eligibility

Bridging loans cater to a specific set of borrowers seeking financial assistance for property transactions. Here’s a quick overview of who qualifies:

Individuals, partnerships, and companies: Sole proprietors, business ventures, and even established corporations can apply.

- Property Focus: Common uses involve purchasing or renovating residential or commercial properties.

- Age Requirement: Generally, you must be 18 or older, with some lenders setting a maximum age limit.

- UK Residency: Living or having a registered address in the UK is essential.

- Secured Loan: Providing collateral, typically property, is mandatory.

Having a plan to pay back the loan is important. This could include selling the asset used as collateral, getting a long-term loan, or receiving expected money.”

Minimum Loan Amount: Most lenders require a minimum loan amount, often around £10,000.

Your employment status (employed, self-employed, or retired) is usually not as important as the other factors mentioned above.

Lenders may consider credit history and income proof in some cases, even if they are not the main factors. Please be aware of this when applying for a loan. Having a good credit history and providing proof of income are important to increase your chances of approval.

Bridging Loan Costs Explained

Here’s a breakdown of the potential costs associated with a bridging loan:

- Administrative Fee: This one-time fee, typically around £295, covers the processing and handling of the loan application. Note that you can only pay this if we approve and draw the loan.

- Valuation Fees: These fees depend on several factors:

- Property Value: Higher-value properties generally incur higher valuation costs.

- Location: Valuations in certain areas might be more expensive.

- Report Type: A detailed valuation report will cost more than a basic “desk-top appraisal.” While thorough valuations are crucial, we prioritise cost-effective options like desk-top appraisals whenever possible.

You must pay valuation fees directly to the surveyor or lender.

The redemption charge is a fee that pays for the legal costs of removing the lender’s security charge from your property. You incur this fee when you repay the loan. Covering the legal expenses involved in this process is necessary. You must officially remove the lender’s security charge from your property.

Solicitor Fees: The lender will appoint a solicitor to handle legal aspects like loan contracts and securing the property. These legal fees are the responsibility of the borrower. We provide a cost estimate through our online calculator.

Transparency on Our End

No hidden fees! Our loans do not have exit fees, and we do not charge broker fees.

Remember, these are additional costs on top of the loan interest rate. Carefully consider these expenses when evaluating the total cost of a bridging loan.

0116 402 7982

0116 402 7982