Q3 Bridging Loan Transactions Hit New Record High, Despite Higher Interest Rates

For the first time this year, average bridging loan interest rates increased slightly in Q3. But rather than adversely affecting the sector’s popularity and performance, data from Bridging Trends indicates quite the opposite. In the face of adversity, the UK’s bridging finance sector enjoyed its strongest quarter on record in terms of gross contributor lending.

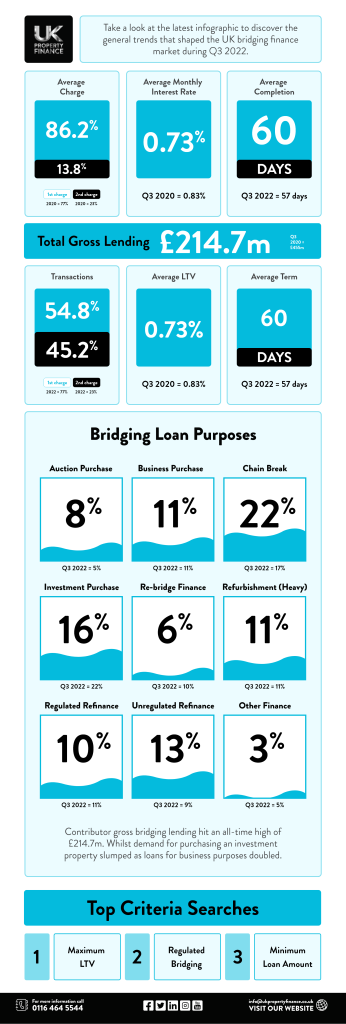

Compared to Q2, quarterly performance increased by a huge 30% in Q3; a total of £214.7 million in bridging loans was transacted across the UK, up from £178.4 million in Q2. This is the highest combined contributor lending total recorded since 2015, when Bridging Trends was launched.

Of equal significance, the Bridging Trends report also showed a major shift in how bridging loans are being used by UK borrowers. For the first time, preventing a property chain break became the top use for bridging finance, accounting for a full 22% of all transactions (up from 21% in the previous quarter).

This bucked the trend of the five prior consecutive quarters when purchasing investment properties was the most common use for bridging finance.

“Following the base rate rises we’ve seen throughout this year and mortgage interest rates increasing across the industry, it’s no surprise that chain break bridging is the biggest use of funds for the quarter,” said Stephen Watts, Bridging & Development Finance Specialist at Brightstar.

“Borrowers that have had mortgage products withdrawn from them with little or no notice or have lost their sale due to their buyers no longer fitting mortgage affordability criteria would then turn to short-term funding solutions to ensure their purchase can still go through as planned. It will be interesting to see how this impacts next quarter’s data.”

Attributed largely to the growing uncertainty that continues to plague the UK economy, the use of bridging finance for investment property purchases plummeted from 24% in Q2 to 16% in Q3.

Interest rates are up slightly

Meanwhile, the average monthly interest rate payable on a bridging loan increased slightly for the first time, up from 0.69% in Q2 to 0.73% in Q3. However, this seemingly had no impact whatsoever on overall bridging activity, which reached a new record high between July and September.

There was also a slight increase in the average loan-to-value level of bridging products issued in Q3—up from 56.2% in Q2 to 59.6%. Regulated bridging loans accounted for 45.2% of all transactions, up slightly from 43.3% in the previous quarter. Average completion times increased slightly to 60 days in Q3 (an increase of three days compared to Q2), which may be a reflection of the record demand for bridging finance also recorded during this period.

While average interest rates continue to hover close to previous record lows, experts believe that further increases over the coming months may be all but inevitable.

“Considering the volumes we have seen in Q3, bridging finance clearly continues to be a useful tool for homeowners and investors alike. What has been interesting is the drop-off in bridging being utilised for investment purchases, which is likely due to buyers taking stock of the current market. While it’s too early for us to really feel the impact of September’s mini-budget, I expect this will be more visible in Q4,” said Gareth Lewis, Commercial Director at MT Finance.

“As predicted in Q2, interest rates have started to slowly rise to 0.73%, but it is worth noting they are virtually on par with Q3 in 2021 (0.72%). What comes next remains to be seen, but I would not be surprised if interest rates continue to rise and investors remain cautious.”

Challenges and Opportunities Ahead for the Bridging Sector

As things stand, you would be hard-pressed to find anyone with genuine optimism for the immediate economic outlook. Inflation in the UK is already hovering close to 11%, but experts are increasingly predicting a peak of almost 19% in the early stages of next year. All of this is likely to make the current living-cost crisis seem insignificant when compared with the economic hardship to come.

Consumer confidence is as low as it gets, average wages are in no way keeping up with escalating living costs, and people are being forced to make all sorts of modifications to their spending patterns simply to make ends meet.

Sadly, experts like Nick Jones, sales director for bridging finance at lender West One Loans, only see things getting worse before they get better.

Flexible finance in troubled times

But while the overall picture is somewhat pessimistic, it may not all be doom and gloom. With the growing availability and affordability of bridging finance, more people and businesses than ever before will at least be able to tide themselves over if facing a temporary economic shortfall.

There will even be those who are able to capitalise on the economic downturn in order to make the best of a bad situation.

“There will be opportunities for customers who are looking to expand their portfolios and make investments, and we will be here to support them,” said Jones.

Elsewhere, bridging and development finance specialist at Brightstar, Stephen Watts, indicated that “bridging finance is being increasingly sought to enable buyers to put themselves ahead of their competition”.

With available housing inventory continuing to outstrip supply by a considerable margin, those able to do so are setting their sights on potentially profitable property investments. And in many cases, they use short-term bridging loans to expand their portfolios at relatively short notice.

Figures from the most recent Bridging Trends Report found that, in spite of the current economic chaos, bridging loan volumes for Q2 this year were up 14%. Throughout the first six months of 2022, the most popular application for bridging finance was picking up an investment property.

The speed and simplicity of home buyers and investors looking to take advantage of time-critical property purchase opportunities. Not to mention, jump the queue and escape the trappings of conventional property chains entirely.

Cash buyer benefits

But it is not just the UK’s more established property investors that are finding bridging finance a useful facility. Conventional homebuyers are finding it increasingly difficult to secure property purchases via conventional channels.

Today, the typical mortgage application takes approximately 12 weeks to underwrite, authorise, and issue. In the meantime, competing buyers have up to three months to submit a superior offer and beat you to the punch.

Coupled with the risk of the seller simply pulling out of the deal at any time, conventional home purchases are becoming increasingly difficult.

With bridging finance, homebuyers can gain access to the benefits of purchasing properties as cash buyers. They borrow against their current home, they fund the purchase of their next home in a matter of days, and they beat all competing bidders to the punch.

In doing so, they eliminate the risk of being gazumped at the last minute and benefit from the property price discounts afforded exclusively to cash buyers (often up to 2% of the total property price).

For as long as the economic situation in the UK remains unstable, the appeal of bridging finance will continue to grow. Particularly for those who are asset-rich but cash-poor, bridging finance can be the ultimate affordable stopgap solution for times of economic turbulence.

How to Boost Your Chance of Being Granted Planning Permission

Planning permission rejections are anything but uncommon. In fact, around 25% of all planning permission applications submitted in England are unsuccessful.

When a request for planning permission is rejected, it can lead to major disruptions and potential financial losses. Submitting repeat applications is an option, but it is far from the most desirable course of action.

Irrespective of the type of project you are planning, the same basic rules must be followed to give your application the best possible chance of being accepted. Understanding the most common reasons planning permission is denied is a good place to start, as most declined applications fail for the same basic reasons.

A few examples include the following:

- Use of hazardous or prohibited materials.

- Overlooking other people’s properties.

- Modifications that would block a neighbour’s natural light.

- Potential impact on trees, nature, and habitat.

- not keeping in with the character of the area.

Conducting adequate preparation when planning an application means understanding and anticipating these potential issues. All aspects of your proposal must be presented in a way that shows you have considered all applicable regulations.

Enlisting expert help at an early stage could also prove invaluable. For example, if you are seeking third-party funding for an extensive project, your provider and/or broker may be able to help with your planning permission application.

In some instances, applications submitted by (or with the support of) a skilled third party carry more weight. The same can be said for those who carry the support or recommendation of a reputable surveyor.

But irrespective of whether you plan on going it alone or seeking outside help, there are four important things you need to do to ensure your application is successful:

- Make sure you provide all the required information the first time: With each declined planning permission application, your likelihood of success the next time around decreases. You, therefore, need to ensure that you have all the required information and documentation in place the first time.

To submit an application for any kind of project, the following will be needed:

- Five copies of the application form.

- A signed ownership certificate.

- A Design and Access Statement.

- The planning permission fee.

- A site plan, which shows the planned changes in detail.

- A block plan that shows the location of the site in the local area.

- Elevations of the proposed site.

Be mindful of the fact that if any documentation is absent or incomplete, the application as a whole will be rejected.

It is advised that you:

- Provide detailed building models: If possible, accompany your planning permission application with a detailed digital model of your proposed building (or modification). BIM models can be great for showing how the finished project will look in its surroundings and whether it will comply with all applicable regulations.

- Demonstrate your understanding of the rules: Your job is to convince the local council that you have considered and carefully considered all applicable rules and requirements. From accessibility to sustainability to health and safety, a demonstration of compliance and understanding holds the key to a successful application.

- Provide evidence of due diligence: Finally, you can also boost the chances of the application being successful if you provide robust evidence of due diligence. This means showing that you have conducted extensive research into how your project will comply with all local and national regulations. For example, you could accompany your application with an architect’s drawing, providing a clear indication of how your project will fit in with its surroundings.

What’s Happening in the BL Market (and Why Borrowers Are Reaping the Benefits)

As if the UK’s economic picture wasn’t already sketchy enough, its future outlook is even gloomier. The cost-of-living crisis is likely to worsen before it improves, with the Bank of England warning that inflation could go beyond 10% before the year is out.

But there is at least one positive in all the doom and gloom, at least from a bridging finance perspective; while all this is going on, the bridging loans sector is not only booming but is also offering its most competitive products in history to a growing audience of borrowers.

Application volumes and inquiry levels continue to hover at unprecedented highs as businesses and consumers alike take their businesses away from the major High Street banks. The more difficult and expensive it becomes to qualify for conventional loans or mortgages, the greater the tendency to seek unconventional alternative options.

One of which is bridging finance, which, due to its speed, flexibility, and accessibility, has skyrocketed in popularity over the past couple of years.

“This is great news, of course, particularly in the challenging economic environment,” said Vic Jannels, chief executive at The Association of Short-Term Lenders (ASTL).

“The latest ASTL lending data for the final three months of last year has revealed that completions were £1.2m for the quarter, which represents a record high and an increase of 19% on the previous quarter. This has led to another increase in loan books, which now stand at £5.08bn,” added Jannels.

Housing market competition: A key driver

Gross bridging loan completions were up a full 32% (reaching £485 million) during the first six months of last year, increasing further to an impressive 52% by November. This momentum has been largely maintained throughout 2022, resulting in average bridging loan interest rates hitting a new all-time low.

All of which is playing right into the hands of prospective homebuyers, many of whom are becoming increasingly disenchanted with what is available on the High Street, if not entirely out of the running for mortgage loans, due to increasingly strict lending criteria.

Demand for affordable homes continues to outstrip supply in almost every part of the UK. For buyers looking to avoid regrettable chain-break scenarios, bridging finance is offering a fast-access lifeline. Secured against their current home, a bridging loan can be used to buy their next home outright and allow plenty of time to sell their previous home for its full market value.

In addition, property developers are turning to bridging finance to fund purchases and renovations of vacant properties across the country. As most major banks continue to classify homes in questionable condition as ‘not mortgageable’, developers are finding themselves with little choice but to explore the alternative options available.

Matthew Arena, managing director at Brilliant Solutions, believes that the bridging finance sector is playing a major role in easing at least some of the pressure the housing sector is under.

“Bridging is performing well and has helped with several key housing issues,” he said.

“With property supply being so scarce, the ability of investors to develop or refurbish property and sell quickly is driving the sector,”

“Equally, the regulated element of the business is growing as the drive to move is as high as ever and suitable property is so difficult to find.”

“This is leading to more refurbishment and also a higher tendency to pay for bridging as a chain-break solution because there is a greater certainty of sale and a higher perceived loss if the opportunity falls through.”

Competitive finance with flexible terms

Unsurprisingly, demand for fast-access bridging finance has triggered a major spike in product availability from a growing network of specialist lenders. Once a fairly niche field, the bridging sector has become fiercely competitive.

Covering the needs of consumers and businesses alike, there are so many lenders now fighting to get new customers on board that average interest rates have been plummeting. It is now the norm to be offered a bridging loan with a monthly interest rate in the region of 0.5% or less, having once been reserved exclusively for prestige clients.

Meanwhile, associated borrowing costs (arrangement fees, transaction fees, completion fees, etc.) have likewise been dropping for some time, if not being removed entirely by many bridging specialists.

Alongside increasingly competitive deals, the flexibility of bridging finance is also proving a big draw for prospective borrowers. Employment status, proof of income, financial position, credit score, none of the usual obstacles apply to bridging finance applications.

Bridging loans are issued primarily based on two things: the provision of assets of value to cover the costs of the loan and evidence of a viable exit strategy for timely repayment. No jumping through hoops and no need to disclose your entire life story, as remains the case on the High Street.

All of which paints a picture of a booming bridging finance sector that’s becoming increasingly attractive to borrowers from all backgrounds. And with more economic doom and gloom on the horizon, it is a trend that looks set to continue for some time to come.

Average London Rents up 22% as Return to City Life Accelerates

London’s private rental market experienced an unprecedented decline in popularity during the pandemic, as millions exited the UK’s biggest towns and cities in search of solace and safety elsewhere. Working from home became the new norm, and it was no longer necessary to pay extortionate prices to rent properties in and around London.

Today, data suggests the return to city life is well underway, as average London rent prices accelerate at their fastest pace on record.

This year to date, a full 30% of all new tenancies in London have been secured by individuals moving into the capital from other parts of the country. That’s according to the Hamptons Letting Index, which also indicates a massive 12.3% average increase in monthly rental costs in London over the past 12 months.

On average, it now costs £1,886 to rent a home on the private market in London, up from £1,680 per month this time last year.

The figures for Inner London are even more astonishing, where average monthly rent prices have skyrocketed by 22% over the course of 12 months. It now costs £2,513 to rent an Inner London home today, £500 more than a year ago.

An impressive rebound

The capital’s return to popularity and prosperity has been impressive, considering that just 12% of new tenants in London came from outside the city in 2020. After this, millions set their sights on more affordable rental homes outside London or moved back in with their parents temporarily to save money.

According to the figures from the Hamptons, most of those heading back into London are relocating from Berkshire, Buckinghamshire, Essex, Hertfordshire, Kent, or Surrey.

Speaking on behalf of Hamptons, head of research Aneisha Beveridge said that the return to the new normal would most likely continue pushing average London rental prices higher.

“With COVID being pushed further to the back of people’s minds, life in the capital is slowly returning to its new normal. Tenants are returning to the bright lights of the city, and this is driving rental growth to record highs,” she said.

“The rise of remote working means that fewer tenants are moving to the capital specifically for work. In fact, a growing number of tenants choosing to live in London are working fully remotely and could live nearly anywhere in the country. The footloose nature of many jobs today means that it will be culture and lifestyle rather than employment that become the capital’s biggest draw.”

“The current pace of London rental growth is predominantly down to the capital playing catch up with the rest of the country.”

“Today, the average rent in London stands 103% above the average outside the capital. While this gap is up from 96% a year ago, it remains below the 120–30% pre-COVID premium, which has been eroded by strong rental growth outside the capital in recent years. But the current pace of rental growth in London is likely to push the premium closer to its pre-COVID level within two years.”

Rental Rates to Rise by Around £800 Per Annum Causing Financial Difficulty for Many Tenants

Experts from rental platform Ocasa are warning that in as little as a year’s time, rental rates could rise by as much as a whopping £800 per year for most tenants.

Even though the rental market in the UK is somewhat back on track following the COVID pandemic and the inevitable lockdowns, the report by Ocasa revealed that the average cost of a rental property is now £12,936 per year for tenants across the UK.

The yearly cost of renting a property has already increased by £1,032 in the last twelve months, and the report expects this figure to rise even more in the coming year. It is predicted that increases of around £803 in the next year will be a reality, making it even more difficult for tenants to meet their monthly rental obligations and making it even more challenging to save a deposit in order to get onto the property ladder. So looking forward to this time next year, tenants will be paying, on average, £13,739 for their annual rent.

Where are the biggest increases?

It’s no surprise that London has the country’s highest rental rates and is therefore the area that is least affordable to most tenants. The average rent in the capital is currently £21,140 per year, a figure significantly higher than the rest of the UK. The report shows that Londoners can expect to see a hike in rental charges of £1,140 per year in the next 12 months.

Despite London being the most expensive place to rent, when looking at percentages, the North West is predicted to see the sharpest increase in rental rates in the next twelve months. The average price for rental property is currently £10,452, but Ocasa has forecast a significant rise of £1,504 by this time next year.

The third-largest increase can be seen in the East of England, where tenants are now paying on average £12,528 but are expected to be paying £13,426 in the next twelve months, equating to an increase of £898.

The South West will see a rental hike of around £790 in the same time period, while the South East will see rises of £750, and the East Midlands are predicted to see a £717 rise in rent per year.

The lowest figures in the report relate to the North East, where increases will, on average, equate to £617 over the next twelve months.

A spokesperson for Ocasa comments: “Despite a rather unsettled rental market landscape as a result of the pandemic, the average UK tenant is still paying over a thousand pounds more a year versus just 12 months ago.”

“This cost is set to climb even further over the next 12 months, and this will be particularly concerning for those residing within the sector.”

They add, “Renting is already the most substantial outgoing they face, but in recent weeks, many will have also seen their finances squeezed by the increasing cost of living.”

“When you add an increase in rental costs to this mix, it paints a very bleak picture for the year ahead.”

Where Are the Cheapest and Most Expensive Places to Rent a Home in the UK?

Once again, the latest figures from the HomeLet rental index indicate that London is the most expensive place in the UK to rent a property from a private landlord. The average monthly rent in London has climbed a further 6.4% since the same time last year, now coming out at £1,752 per calendar month.

The second most expensive region in the UK for renting remains the South East of England, where it now costs an average of £1,139 per month to rent a home privately, 6.1% up from the same time last year. The South West has also seen significant monthly average rent growth over the past 12 months, up 7.6% to reach a new high of £971 per calendar month.

At the opposite end of the scale, the cheapest place in the UK for private rentals is the North East of England. Average rents in the region now stand at £578 per calendar month, up just 1% from the month before and an increase of 3.6% since September.

On average, it now costs £1,061 per month to rent a home privately in the UK, an increase of 7.5% from last year and a 0.8% increase from September.

The second-cheapest place to rent a home in the UK is Northern Ireland, where the average monthly rent now stands at £705. This was followed closely by Yorkshire and the Humber with an average monthly rent of £725, after which came Wales at £734 and the East Midlands at £735.

Wales recorded the highest annual growth of all, with average rents increasing by just under 13% since the same time last year. Scotland came in second with an average monthly rent growth of 10.8% over the past 12 months.

Issues with affordability

Private renters in London continue to spend the largest proportion of their income on rent than those in other parts of the UK, a full 33.7% of their take-home pay. By contrast, renters in the North West spend, on average, 22.1% of their income on monthly rent bills.

Head of marketing at HomeLet & Let Alliance, Matthew Carter, commented on how the ongoing gap between supply and demand is continuing to fuel sky-high rents.

“Typically, rental prices rise in line with inflation and wage growth; that’s something we’ve continued to see. Despite record rents, tenants moving home spend a similar percentage of their income on their monthly rent,” he said.

“Housing follows the same fundamental laws of economics as other goods that consumers need. Ultimately, demand, coupled with lower stock levels for certain types of property, is driving up rental values. The concern is that we’re at a point where there are some areas with exceptionally high demand. Landlords and the lettings market have faced a continued raft of changes and legislation; the government needs to carefully consider how any future policy might impact the 4.5 million households in the private rented sector. The government’s push on homeownership shouldn’t be done to the detriment of an industry that plays a critical role in UK housing.”

Britain’s 10 Fastest Property Price Growth Locations, Revealed

The figures are in, and Toxteth has been named the fastest property price growth location in the country right now. A surprise leader at the top of the table, property prices in Toxteth have skyrocketed an astonishing 20% on average over the past 12 months.

Rightmove’s latest round-up of property price growth figures indicates similarly impressive performance for house prices in Accrington in Lancashire, Retford in Nottinghamshire, and Heywood in Greater Manchester, all achieving 19% growth over the course of a year.

The top ten property price growth locations remain dominated by hotspots in the North West, where the region as a whole has seen an average house price increase of 8% since September 2020.

Record asking prices across the country

The figures from Rightmove suggest that property prices have hit record highs in more than 70% of areas across the country since the beginning of the year. Overall average house prices in Britain are currently up 5.8% compared to the same time last year, reaching a new average asking price of £338,462.

Speaking on behalf of Rightmove, director of property data, Tim Bannister, said that record-high prices continue to be fuelled by unprecedented demand and competition among prospective buyers.

“The number of homes for sale is at a record low, and buyer demand remains high,” he said.

The full listings of the top 10 property price growth locations in Britain published by Rightmove are as follows:

- Toxteth, Liverpool, and Merseyside, £151,958, 20% higher than September 2020.

- Accrington, Lancashire, £139,220, 19% higher than September 2020.

- Retford, Nottinghamshire, £210,761, 19% higher than September 2020.

- Heywood, Greater Manchester, £194,634, 19% higher than September 2020.

- Brixham, Devon, £318,859, 18% higher than September 2020.

- Crowborough, East Sussex, £501,537, 18% higher than September 2020.

- Aberdare, Rhondda Cynon Taf, £165,322, 18% higher than September 2020.

- Moortown, Leeds, West Yorkshire, £327,804, 17% higher than September 2020.

- Penwortham, Preston, Lancashire, £251,478, 17% higher than September 2020.

- Great Sankey, Warrington, Cheshire, £270,621, 16% higher than September 2020.

With an average property price of just under £152,000, Toxteth in Liverpool remains one of the cheapest areas in Britain to buy a home. Average house prices in the region have increased significantly from the £126,806 recorded in September last year.

Representing James Kristian Estate Agents in Liverpool, Warren Matthews said that ongoing improvements across the region had resulted in much greater interest among investors and first-time buyers alike.

“This has pushed demand up, increasing prices in the area, and we’re still seeing high levels of buyer interest as we approach the final months of the year,” he explained.

0116 402 7982

0116 402 7982