Can Anyone Get a Bridging Loan?

In the dynamic world of property transactions and financial emergencies, bridging loans have emerged as a lifeline, providing temporary funding solutions to bridge the gap between financial requirements and available resources. While these versatile loans offer a helping hand, a common question arises: Can anyone get a bridging loan? The answer, though seemingly straightforward, involves a nuanced understanding of eligibility criteria, lender requirements, and the importance of seeking expert guidance.

Eligibility criteria: the gatekeepers of bridging loans

Bridging loans, unlike traditional mortgages, do not adhere to rigid eligibility criteria. Instead, lenders focus on assessing the specific circumstances of each borrower, considering factors such as:

- Loan Purpose: The intended use of the bridging loan is critical in determining eligibility. Loans for property transactions, business funding, or unforeseen expenses are typically prioritised by lenders.

- Loan amount: The requested loan amount is weighed against the borrower’s financial situation and the value of the property being used as security (if applicable).

- Credit history: A borrower’s credit history reveals information about their repayment history as well as their overall financial responsibility. Borrowers with a good credit history are preferred by lenders.

- Property equity: If the bridging loan is secured by a property, the lender will determine the maximum loan amount based on the borrower’s equity in the property.

- Exit strategy: It is critical to have a clear exit strategy outlining how the loan will be repaid. Lenders want to ensure that the loan is repaid in a timely manner.

Lender requirements: tailored to individual needs

While eligibility criteria provide a general framework, individual lenders may have specific requirements.

These may include:

- Minimum and maximum loan amounts: Lenders may set minimum and maximum loan amounts they are willing to provide.

- Property type: Some lenders may specialize in financing specific property types, such as residential or commercial properties.

- Repayment term: Repayment terms for bridging loans can vary, and lenders may have preferences for certain timeframes.

- Interest rates: Interest rates on bridging loans can differ based on the lender’s risk assessment and market conditions.

Navigating the maze: the role of a broker

Given the complexities of bridging loan options and the importance of obtaining favourable terms, consulting with an experienced broker can be extremely beneficial. A trustworthy broker acts as a go-between for borrowers and lenders, offering expert advice, comparing options, and negotiating favourable terms on your behalf.

UK Property Finance: your trusted partner in bridging loan solutions

UK Property Finance is a leading provider of bridging loan solutions in the United Kingdom. With a large network of lenders and a thorough understanding of the market, ukpropertyfinance.co.uk can assist you in locating the best bridging loan for your specific needs. Their experienced team of brokers will walk you through the entire process, from initial assessment to loan closing, ensuring a smooth and successful outcome.

In conclusion:

The question of who can get a bridging loan is not a simple yes or no. Eligibility depends on a combination of factors, including the borrower’s financial situation, the purpose of the loan, and the lender’s requirements. While anyone can potentially apply for a bridging loan, securing the right terms and navigating the maze of lenders can be challenging. Seeking guidance from a trusted broker like UK Property Finance can significantly increase your chances of securing the ideal bridging loan solution for your needs. With expert guidance and a clear understanding of your financial situation, you can unlock the doors to short-term finance and bridge the gap towards your goals.

How are Bridging Loans Calculated?

In the world of property transactions, bridging loans play a crucial role in bridging the financial gap between the sale of one property and the purchase of another. These short-term loans are typically secured against the property being purchased and are designed to provide temporary funding until the borrower can secure long-term financing.

Calculating a bridging loan can seem like a complex process, but understanding the key factors involved can help you make informed decisions and ensure a smooth transaction. This comprehensive guide will delve into the intricacies of bridging loan calculations, providing you with the knowledge you need to navigate this financial aspect of your property purchase.

Factors affecting bridging loan calculations

Several factors influence the calculation of a bridging loan, including:

- The loan amount: The loan amount is a major determinant of the overall cost of your bridging loan. The higher the interest payments and associated fees, the larger the loan amount.

- The loan-to-value ratio (LTV): The LTV represents the percentage of the property’s value that is covered by the bridging loan. LTV limits are typically set by lenders, and a higher LTV may result in a higher interest rate.

- The loan term: The loan term refers to the length of time you borrow money. Longer loan terms typically result in higher interest rates.

- Interest Rate: The interest rate is the percentage of the loan amount that you pay as interest over the term of the loan. Bridging loan interest rates can vary depending on the lender, your credit history, and the loan’s overall risk.

- Fees: Bridging loans may incur fees in addition to interest, such as arrangement fees, valuation fees, and legal fees.

Calculating the gross loan amount

The gross loan amount is the total amount you will repay, including the principal loan amount and the accumulated interest. It is calculated using the following formula:

“Gross Loan Amount = Net Loan Amount + Interest Charges”

Calculating interest charges

Bridging loan interest can be calculated in two ways:

- Monthly interest: Interest is calculated and paid monthly based on the outstanding loan balance.

- Rolled-up interest: Interest is accrued and added to the principal loan amount each month, increasing the outstanding balance and the overall interest charges over the loan term.

Additional considerations

Apart from the factors mentioned above, other considerations may influence bridging loan calculations:

- Your exit strategy: The lender may consider your exit strategy, which refers to the plan for repaying the bridging loan, such as refinancing or selling the property.

- The property type: The type of property being used as security may affect the interest rate and LTV limits.

- Your credit history: Your credit history plays a significant role in determining the interest rate and the lender’s willingness to provide a bridging loan.

Seeking professional guidance

Bridging loan calculations can be complex, and it’s always advisable to consult with a qualified financial advisor or bridging loan specialist. They can help you understand the various factors involved, compare different loan options, and ensure you secure the most suitable bridging loan for your specific needs.

In conclusion

Bridging loans can be a valuable tool in facilitating smooth property transactions. Understanding the factors involved in bridging loan calculations empowers you to make informed decisions, choose the most appropriate loan option, and negotiate favourable terms with lenders. By consulting with experienced professionals, you can navigate the intricacies of bridging loan calculations and maximise the benefits of this short-term financing solution.

Bridging Loans for Overseas Property Development: Unlocking Global Opportunities

At UK Property Finance, we recognise the allure of overseas property development as an enticing investment avenue. In today’s interconnected world, where boundaries are becoming increasingly fluid and international travel is more accessible than ever, individuals and businesses are eager to explore global opportunities. However, financing overseas property development projects can be complex. That’s precisely why we believe in the transformative power of bridging loans to unlock these exciting prospects on a global scale. In this blog post, we will delve into the potential of bridging loans for overseas property development and how they can assist investors in seizing global opportunities.

Understanding overseas property development

Overseas property development involves acquiring and developing properties in foreign countries. It encompasses a range of real estate projects, including residential, commercial, and mixed-use developments. The appeal of overseas property development lies in the potential for high returns, diversification of investment portfolios, and the ability to capitalise on emerging markets.

The role of bridging loans in overseas property development

Bridging loans serve as valuable financial tools for overseas property development. These short-term loans bridge the gap between property purchases and long-term financing or cover construction and renovation costs. By providing borrowers with quick access to funds, typically within weeks, bridging loans enable them to move forward with their projects promptly.

The advantages of bridging loans for overseas property development:

Bridging loans offer several distinct advantages for overseas property development ventures. They provide investors with the necessary capital to acquire land, develop properties, or renovate existing structures, even in foreign countries where securing traditional financing can be challenging.

Flexibility is a key feature of bridging loans for overseas property development. These loans can be customised to meet the specific requirements of the project, including loan duration, repayment terms, and the release of funds at different stages of development. This flexibility allows developers to adapt to the unique challenges and timelines associated with overseas projects.

Collaborating with experienced lenders

When considering a bridging loan for overseas property development, it is essential to partner with experienced lenders who specialise in international financing. These lenders possess in-depth knowledge of the complexities involved in financing projects abroad and can provide valuable guidance throughout the process.

Experienced lenders understand the legal and regulatory frameworks of various countries, assisting borrowers in navigating potential hurdles. They also offer insights into local market conditions, project feasibility, and risk mitigation strategies, empowering investors to make well-informed decisions.

Furthermore, established lenders with global networks can facilitate connections with local experts, including legal professionals, architects, contractors, and property management teams. This network of professionals streamlines the development process and ensures compliance with local regulations.

Overseas property development offers exciting global opportunities for investors and developers seeking diversification and higher returns. However, securing financing for such projects can be challenging, particularly when dealing with unfamiliar legal and economic environments. Bridging loans offer a practical and flexible solution for funding overseas property development, providing quick access to capital and tailored financing options.

To embark on bridging loans for overseas property development, it is vital to collaborate with experienced lenders who understand the intricacies of international financing. Their expertise, combined with a network of professionals in the target country, significantly enhances the success and profitability of the project.

As global opportunities continue to emerge in the property development sector, bridging loans for overseas projects are poised to play a crucial role in empowering investors and developers to capitalise on these exciting ventures. With the right financing partner and thorough due diligence, investors can turn their global property development aspirations into reality.

What Is an Inheritance Tax Loan?

Dealing with the death of a loved one can be challenging enough, and having to decipher complex tax terms and procedures can make it even more overwhelming. One such concept that may surface during this time is the inheritance tax (IHT) levied on the deceased’s property that is passed on to beneficiaries.

You may find yourself in a position where, despite being owed a significant sum by way of legally entitled inheritance, you lack the on-hand funds to meet your own inheritance tax requirements, which can feel like something of a dead end but can be resolved quite simply (and affordable) with a bespoke financial solution.

Understanding current IHT thresholds

The inheritance tax threshold, or “nil rate band”, is currently £325,000. If the value of the estate, including the value of any assets given away or sold at a reduced price within the last seven years before death, is below this threshold, there will be no IHT payable.

However, if the deceased’s estate worth exceeds the £325,000 threshold, the portion exceeding the threshold is taxed at a rate of 40%. These high tax rates often put pressure on beneficiaries, especially if the majority of the estate’s value is tied up in non-liquid assets, like property. This is why many find it difficult to pay IHT, leading them to seek alternative funding options.

What are inheritance tax loans?

This is where an inheritance tax loan comes in. It is essentially a loan taken out to pay the inheritance tax due on an estate. These loans are generally short-term and are repaid once the estate’s property is sold off or other funds become available.

The main point of appeal with this type of funding is that it ensures the prompt settlement of the IHT bill, avoiding any potential penalties for late payment. Moreover, it buys time for the inherited assets to be retained and/or sold at a later date for their full value, instead of selling them off in a rush (at a potentially lower price) to reconcile tax debts.

Of course, being able to access the estate you are legally entitled to early is also a huge benefit. The issue has traditionally been (albeit somewhat ironic) that the more you are owed, the more difficult it is to meet your own tax obligation to complete the probate process.

How IHT loans work

When you apply for an IHT loan, a lender essentially offers funds secured against the inherited assets. The assets you will be inheriting are used as collateral against the loan, which technically means that the lender has the right to repossess them if you do not repay your debt as agreed.

Once the loan is approved, which can be as fast as a few working days, you can use it to pay your IHT bill, and the debt is later repaid when the inherited asset (usually property) is sold or from other funds.

Applying for an IHT loan

While it is possible to apply for an IHT loan directly with a lender, doing so is not always the best option. In terms of both getting the best deals and lightening the load for yourself, it is always best to seek independent broker support.

A broker can help you navigate the complexities of IHT loans, putting their knowledge and contacts within the industry to good use and making the process as smooth and simple as possible. Your broker will guide you every step of the way, helping relieve at least some of the pressure of your financial responsibilities during an already difficult time.

For more information or to discuss the potential benefits of inheritance tax loans in more detail, contact a member of the team today.

Six Steps to Better Household Budgeting

What is the common problem shared by most budgets? It is a fact that they simply do not work.

This is because most budgets are formulated by well-meaning households on the fly. Rather than careful planning, people have a tendency to make up their budgets as they go along.

This is a shame, given how careful budgeting can pave the way for a more comfortable and prosperous financial future. More specifically, a well-planned budget can help you determine two important things:

- Are you spending more than you earn?

Without exception, outgoings that exceed income equal a recipe for disaster. Not to mention a mounting debt spiral that could prove catastrophic. If you are spending even slightly above your means, you need to make the necessary adjustments as soon as possible. This is the single most important reason to plan your budget carefully.

- How much can I afford to spend?

This is basically where you conduct all the calculations needed to work out your spending power. If you are making things up as you go along, this means you are running the risk of spending more than you can afford to. Meanwhile, working out exactly how much disposable income you have paves the way for financial stability. You know exactly how much you have to spend, so you can make sure you don’t spend too much.

Essential tips for household budgeting

All budgets are different, but they are nonetheless built around the same six considerations.

Each of the following will help you produce a workable budget for your household and avoid falling into debt:

- Collect all receipts and record all expenses

Keeping track of even a single week’s expenses mentally is practically impossible. Over the course of the average month, there will be dozens of minor (and not-so-minor) outgoings you completely forget about. Hence, the only way to be sure about what you are spending is to keep a full and formal record of every expense. Keep track of every receipt you’re handed and log your expenses in a journal or spreadsheet.

- Establish your objectives for your budget

Budgeting is only effective and satisfying when you have a specific goal in mind. Are you looking to put away more cash for a rainy day? Maybe save up for a well-deserved holiday. Or do you simply need to establish a financial safety net in case things take a turn for the worse? You need goals and objectives to work towards in order to make things happen.

- Avoid the temptation to guess or to round things up

Accuracy is the key to an effective budget. This means being as accurate as you can with your records and your calculations, avoiding the temptation to guess or to round things up. Over the course of time, minor discrepancies in accuracy can add up to a big difference on your long-term balance sheets.

- Divide your outgoings into ‘wants’ and ‘needs’

After recording your outgoings for a month or two, take the time to separate all expenses into two sections. One of these sections should be necessary expenses: rent bills, mortgage payments, utilities, groceries, and fuel bills, all mandatory and unavoidable. The other should be optional expenses, eating out, personal indulgences, entertainment, and anything else you don’t strictly need. It’s from this column that things can be adjusted as necessary in order to save money.

- Consider repaying smaller debts

If possible, it is worth considering repaying some (or all) of your smaller debts. With credit card balances, personal loans, and overdrafts, the interest payable on facilities like these can quickly stack up. The more debts you repay, the more interest you convert into extra cash in your pocket at the end of the month.

- Calculate your disposable income

Calculating your disposable income is as simple as tallying all of your monthly outgoings and subtracting this figure from your monthly income. The figure you are left with is your disposable income, minus things like pension contributions, savings, and so on. Once you have an exact end-of-month figure to work with, it becomes much easier to make safer and savvier spending decisions.

What are the Alternatives to Bridging Loans?

While a bridging loan can be a useful tool for certain types of financing needs, it may not always be the best option for everyone.

Here are a few reasons why you might consider an alternative to a bridging loan:

- High interest rates: Bridging loans can have high-interest rates and fees compared to other types of loans, which can make them more expensive over time.

- Short-term nature: Bridging loans are typically designed for short-term financing needs, such as covering the gap between the purchase of a new property and the sale of an existing property. If you’re looking for longer-term financing, such as for a home renovation project, you may want to consider other options that offer more flexibility and lower interest rates.

- Risky nature: Bridging loans can be risky, as they are secured against the property being sold. If you are unable to sell the property or the sale falls through, you could be left with a significant amount of debt that you are unable to repay.

- Other options available: There are many other financing options available, such as home equity loans, personal loans, and credit cards, that may offer more favourable terms and be better suited to your individual needs and financial situation.

Ultimately, it’s important to carefully consider your financing options and choose the option that best meets your needs and budget. Be sure to compare interest rates, fees, and terms carefully when considering different types of loans, and work with a reputable lender to ensure that you’re getting a good deal.

What are the other options?

Remortgaging your property

Remortgaging your property is one way to get financing by borrowing against the equity in your home. Essentially, remortgaging means taking out a new mortgage on your property while paying off your existing mortgage.

Here are the steps you need to take to get financing by remortgaging your property:

- Assess your current mortgage: Before considering remortgage, you should review your current mortgage agreement to see if there are any early repayment charges or exit fees. This will give you an idea of whether it is worth remortgaging and whether you will save money by doing so.

- Determine the value of your property. You will need to have your property valued to determine its current market value. This will help you to understand how much equity you have in your property, which is the difference between the value of your property and the outstanding mortgage amount.

- Shop around for remortgage deals. Once you have assessed your current mortgage and determined the value of your property, you can start shopping around for remortgage deals. Consider factors such as the interest rate, term, fees, and any additional benefits such as cashback or free valuations.

- Apply for a remortgage: Once you have found a suitable remortgage deal, you will need to apply for it. The lender will review your application, credit history, and affordability and may require additional documentation such as proof of income and identification.

- Pay off your existing mortgage: If your application is successful, the new lender will pay off your existing mortgage, and you will start making payments on the new mortgage.

- Use the released equity: If you have sufficient equity in your property, you can use the released equity to finance a variety of needs, such as home improvements, debt consolidation, or investing in a business.

It’s important to note that remortgaging comes with its own risks, such as increasing your debt or monthly payments, and should be approached with caution. It’s important to seek independent financial advice before making any decisions.

Taking out a secured loan

Secured loans and bridging loans are two different types of financing options that are often used for different purposes. A secured loan is a loan that is backed by collateral, such as a house or a car, while a bridging loan is a short-term loan that is often used to bridge the gap between the sale of one property and the purchase of another.

If you are looking for a financing option that offers lower interest rates and longer repayment terms, then a secured loan may be a good alternative to a bridging loan. With a secured loan, you can borrow a larger amount of money and spread the repayment over a longer period of time. This can help you manage your cash flow more effectively and avoid the high-interest rates and fees associated with a bridging loan.

Another advantage of a secured loan is that the interest rates are typically lower than those of an unsecured loan or a bridging loan because the lender has the security of your collateral. This means that you may be able to save money over the long term by choosing a secured loan instead of a bridging loan.

However, it’s important to remember that a secured loan also carries the risk of losing your collateral if you are unable to make the payments on time. So, it’s important to make sure that you can afford the repayments before taking out a secured loan.

In summary, if you are looking for a financing option that offers lower interest rates and longer repayment terms and you have collateral to secure the loan, then a secured loan may be a good alternative to a bridging loan.

Personal unsecured loan

A personal unsecured loan is a type of loan that does not require collateral to secure the loan. Instead, the lender will assess your creditworthiness based on your credit score, income, and other financial factors. A bridging loan, on the other hand, is a short-term loan that is typically secured against a property or other assets.

There are several reasons why a personal unsecured loan may be a good alternative to a bridging loan:

- Lower interest rates: Personal unsecured loans typically have lower interest rates than bridging loans. This is because the lender is taking on less risk by not requiring collateral. As a result, you may be able to save money on interest charges by choosing a personal unsecured loan instead of a bridging loan.

- Longer repayment terms: Personal unsecured loans also typically offer longer repayment terms than bridging loans. This can make it easier for you to manage your cash flow and repay the loan over a longer period of time.

- No risk of losing collateral: With a personal unsecured loan, you do not have to put up any collateral to secure the loan; this means that you do not have to worry about losing your property or other assets if you are unable to repay the loan.

- More flexible: Personal unsecured loans are also typically more flexible than bridging loans. You can often use the funds for a wider range of purposes, and the loan application process is often faster and simpler.

Overall, if you do not have collateral to secure a loan or if you want to avoid the risk of losing your collateral, a personal unsecured loan may be a good alternative to a bridging loan. It’s important to compare interest rates and repayment terms from different lenders to find the best option for your needs.

Let-to-buy mortgages

A let-to-buy mortgage is a type of mortgage that allows you to convert your existing home into a rental property while you purchase a new home to live in.

This can be a good alternative to a bridging loan for several reasons:

- Avoid paying two mortgages: With a let-to-buy mortgage, you can avoid paying two mortgages at the same time. This is because you can use the rental income from your existing property to help cover the mortgage payments while you move into your new home. This can be a more cost-effective solution than taking out a bridging loan, which can be expensive and have high-interest rates.

- No need to sell your existing property: With a let-to-buy mortgage, you don’t have to sell your existing property in order to purchase a new one; this can be beneficial if you want to keep your existing property as an investment or if you are unable to sell it quickly enough to finance the purchase of your new home.

- Longer repayment terms: Let-to-buy mortgages typically have longer repayment terms than bridging loans, which can make the monthly repayments more affordable. This can be helpful if you are on a tight budget or if you are worried about your ability to make the repayments on a bridging loan.

- Lower interest rates: Let-to-buy mortgages also tend to have lower interest rates than bridging loans, which can save you money over the long term. This is because let-to-buy mortgages are usually longer-term mortgages while bridging loans are short-term loans.

Overall, a let-to-buy mortgage can be a good alternative to a bridging loan if you are looking to purchase a new home while keeping your existing property as an investment. It can help you avoid paying two mortgages at the same time and provide you with a more affordable and longer-term financing solution.

Asset refinancing

Asset refinancing is a financing option that involves using existing assets, such as equipment, machinery, or property, as collateral for a loan.

This can be a good alternative to a bridging loan for several reasons:

- Lower interest rates: Asset refinancing typically offers lower interest rates than bridging loans. This is because the lender has the security of your existing assets, which reduces the risk of default.

- Longer repayment terms: Asset refinancing also typically offers longer repayment terms than bridging loans. This can make it easier to manage your cash flow and repay the loan over a longer period of time.

- There is no need to sell assets. With asset refinancing, you do not have to sell your assets in order to secure the loan. This can be beneficial if you want to keep your assets for future use or if you are unable to sell them quickly enough to finance the purchase of a new property.

- More flexibility: Asset refinancing can also be more flexible than bridging loans. You can often use the funds for a wider range of purposes, and the loan application process is often faster and simpler.

Overall, asset refinancing can be a good alternative to a bridging loan if you have existing assets that you can use as collateral. It can provide you with lower interest rates, longer repayment terms, and more flexibility than a bridging loan. However, it’s important to remember that asset refinancing also carries the risk of losing your assets if you are unable to make the payments on time. So, it’s important to make sure that you can afford the repayments before taking out an asset-refinancing loan.

Popularity of “Offset” Mortgage Grows as Homeowners Strive to Make Savings

Faced with the prospect of ever-increasing mortgage payments and skyrocketing energy bills, households across the UK are being forced to explore all available options to make meaningful savings. Remortgaging to reduce interest rates for a fixed period of time is a popular option, but genuinely cost-effective remortgage deals are becoming increasingly thin on the ground.

Elsewhere, others are turning to a lesser-known facility to reduce their monthly payments and bring their mortgage rates down to a more manageable level. The popularity of “offset” mortgages is growing at a rate not seen in some time as homeowners strive to do everything within their power to make ends meet.

New figures suggest that applications for offset mortgage facilities increased by around 400% in September and October, compared to the same time last year. An offset mortgage provides homeowners with the opportunity to use their savings to “offset” some of their mortgage costs, though, for this reason, the facility is open only to those who have considerable savings at their disposal.

What is an offset mortgage?

With an offset mortgage, the borrower is required to deposit a chunk of their savings into an account that is linked directly to their mortgage. This sum of money is then used to offset the remaining balance on their mortgage, meaning that subsequent interest payments are calculated on the balance of the mortgage less the balance of their linked savings.

This provides those with considerable on-hand savings with the opportunity to significantly reduce their mortgage term and, in doing so, access cheaper rates. For example, a standard mortgage currently attaches an interest rate in the region of 6.5%, whereas the average two-year fixed-rate offset deal charges a much lower 5.5%.

In practice, a mortgage payer with a 25-year £400,000 mortgage charged at 5.5% who offsets £40,000 with their savings could save more than £98,000 over the life of the loan. They would also repay their mortgage three years and three months earlier.

But while the popularity of offset mortgages is growing, their availability remains comparatively sparse on the High Street. More mortgage payers are looking to offset their loans, but figures from Moneyfacts suggest that the number of offset mortgage facilities available has fallen by as much as two-thirds over the past 12 months.

Today, there are just over 50 offset deals available on the market as a whole.

“Lots of our clients like the flexibility these deals provide, especially if they are planning to help a family member on the property ladder and need access to a lump sum for the deposit or they have upcoming development works,” said Aaron Strutt, of broker Trinity Financial.

“Others like to have the money ready to pay school fees, and business owners like to offset mortgages when they receive lump-sum payments.”

Millions of mortgage payers face a three-fold interest increase

While analysts now believe that interest rates will peak at lower-than-expected highs next year, millions are facing the near-inevitable prospect of a massive rise in their monthly mortgage payments.

According to a study carried out by Morgan Stanley, around 40% of introductory mortgage deals are set to expire within the next 12 months. This will leave those exiting low introductory rates facing the prospect of interest rates up to three times higher than they are currently paying. As it stands, the current rate payable on a two-year fixed mortgage (following any introductory rate offers) is around 6.55%.

Q3 Bridging Loan Transactions Hit New Record High, Despite Higher Interest Rates

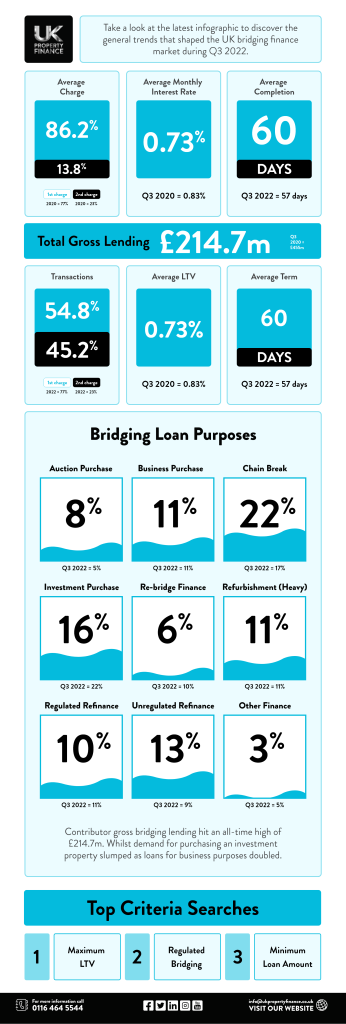

For the first time this year, average bridging loan interest rates increased slightly in Q3. But rather than adversely affecting the sector’s popularity and performance, data from Bridging Trends indicates quite the opposite. In the face of adversity, the UK’s bridging finance sector enjoyed its strongest quarter on record in terms of gross contributor lending.

Compared to Q2, quarterly performance increased by a huge 30% in Q3; a total of £214.7 million in bridging loans was transacted across the UK, up from £178.4 million in Q2. This is the highest combined contributor lending total recorded since 2015, when Bridging Trends was launched.

Of equal significance, the Bridging Trends report also showed a major shift in how bridging loans are being used by UK borrowers. For the first time, preventing a property chain break became the top use for bridging finance, accounting for a full 22% of all transactions (up from 21% in the previous quarter).

This bucked the trend of the five prior consecutive quarters when purchasing investment properties was the most common use for bridging finance.

“Following the base rate rises we’ve seen throughout this year and mortgage interest rates increasing across the industry, it’s no surprise that chain break bridging is the biggest use of funds for the quarter,” said Stephen Watts, Bridging & Development Finance Specialist at Brightstar.

“Borrowers that have had mortgage products withdrawn from them with little or no notice or have lost their sale due to their buyers no longer fitting mortgage affordability criteria would then turn to short-term funding solutions to ensure their purchase can still go through as planned. It will be interesting to see how this impacts next quarter’s data.”

Attributed largely to the growing uncertainty that continues to plague the UK economy, the use of bridging finance for investment property purchases plummeted from 24% in Q2 to 16% in Q3.

Interest rates are up slightly

Meanwhile, the average monthly interest rate payable on a bridging loan increased slightly for the first time, up from 0.69% in Q2 to 0.73% in Q3. However, this seemingly had no impact whatsoever on overall bridging activity, which reached a new record high between July and September.

There was also a slight increase in the average loan-to-value level of bridging products issued in Q3—up from 56.2% in Q2 to 59.6%. Regulated bridging loans accounted for 45.2% of all transactions, up slightly from 43.3% in the previous quarter. Average completion times increased slightly to 60 days in Q3 (an increase of three days compared to Q2), which may be a reflection of the record demand for bridging finance also recorded during this period.

While average interest rates continue to hover close to previous record lows, experts believe that further increases over the coming months may be all but inevitable.

“Considering the volumes we have seen in Q3, bridging finance clearly continues to be a useful tool for homeowners and investors alike. What has been interesting is the drop-off in bridging being utilised for investment purchases, which is likely due to buyers taking stock of the current market. While it’s too early for us to really feel the impact of September’s mini-budget, I expect this will be more visible in Q4,” said Gareth Lewis, Commercial Director at MT Finance.

“As predicted in Q2, interest rates have started to slowly rise to 0.73%, but it is worth noting they are virtually on par with Q3 in 2021 (0.72%). What comes next remains to be seen, but I would not be surprised if interest rates continue to rise and investors remain cautious.”

0116 402 7982

0116 402 7982